Amur Capital Management Corporation Things To Know Before You Get This

Amur Capital Management Corporation Things To Know Before You Get This

Blog Article

Amur Capital Management Corporation Can Be Fun For Anyone

Table of ContentsThe Greatest Guide To Amur Capital Management CorporationThe Greatest Guide To Amur Capital Management CorporationThe Best Strategy To Use For Amur Capital Management CorporationThe Main Principles Of Amur Capital Management Corporation The 8-Minute Rule for Amur Capital Management CorporationNot known Facts About Amur Capital Management CorporationThe Best Strategy To Use For Amur Capital Management Corporation

A reduced P/E proportion may indicate that a firm is underestimated, or that investors expect the company to face much more challenging times in advance. Financiers can make use of the average P/E ratio of other firms in the same industry to create a standard.

The Single Strategy To Use For Amur Capital Management Corporation

The average in the automobile and vehicle sector is simply 15. A stock's P/E proportion is simple to discover on most financial coverage internet sites. This number shows the volatility of a stock in contrast to the market all at once. A safety and security with a beta of 1 will exhibit volatility that corresponds that of the marketplace.

A stock with a beta of above 1 is theoretically more unstable than the market. A safety and security with a beta of 1.3 is 30% even more volatile than the market. If the S&P 500 rises 5%, a stock with a beta of 1. https://www.giantbomb.com/profile/amurcapitalmc/.3 can be anticipated to climb by 8%

Amur Capital Management Corporation Things To Know Before You Get This

EPS is a buck number representing the section of a firm's incomes, after taxes and preferred supply dividends, that is assigned per share of typical stock. Financiers can utilize this number to evaluate exactly how well a business can provide value to investors. A higher EPS results in greater share costs.

If a business routinely falls short to deliver on revenues projections, an investor may wish to reconsider buying the supply - alternative investment. The calculation is easy. If a firm has an earnings of $40 million and pays $4 million in rewards, after that the continuing to be sum of $36 million is split by the variety of shares outstanding

The Best Strategy To Use For Amur Capital Management Corporation

Investors commonly obtain interested in a stock after checking out headings about its extraordinary performance. A look at the fad in prices over the previous 52 weeks at the least is essential to obtain a feeling of where a supply's rate may go next.

Technical analysts comb with enormous quantities of information in an effort to forecast the instructions of supply costs. Essential analysis fits the requirements of the majority of investors and has the advantage of making excellent sense in the actual world.

They believe rates adhere to a pattern, and if they can figure out the pattern they can profit from it with well-timed professions. In recent decades, modern technology has actually allowed even more capitalists to practice this design of investing since the devices and the data are more easily accessible than ever. Essential analysts take into consideration the innate value of a stock.

Little Known Questions About Amur Capital Management Corporation.

Technical evaluation is ideal suited to a person who has the time and convenience degree with information to put infinite numbers to make use of. Over a duration of 20 years, annual costs of 0.50% on a $100,000 financial investment will reduce the profile's worth by $10,000. Over the same duration, a 1% cost will certainly minimize the exact same portfolio by $30,000.

The trend is with you (https://visual.ly/users/christopherbaker10524/portfolio). Take advantage of the trend and store around for the lowest cost.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

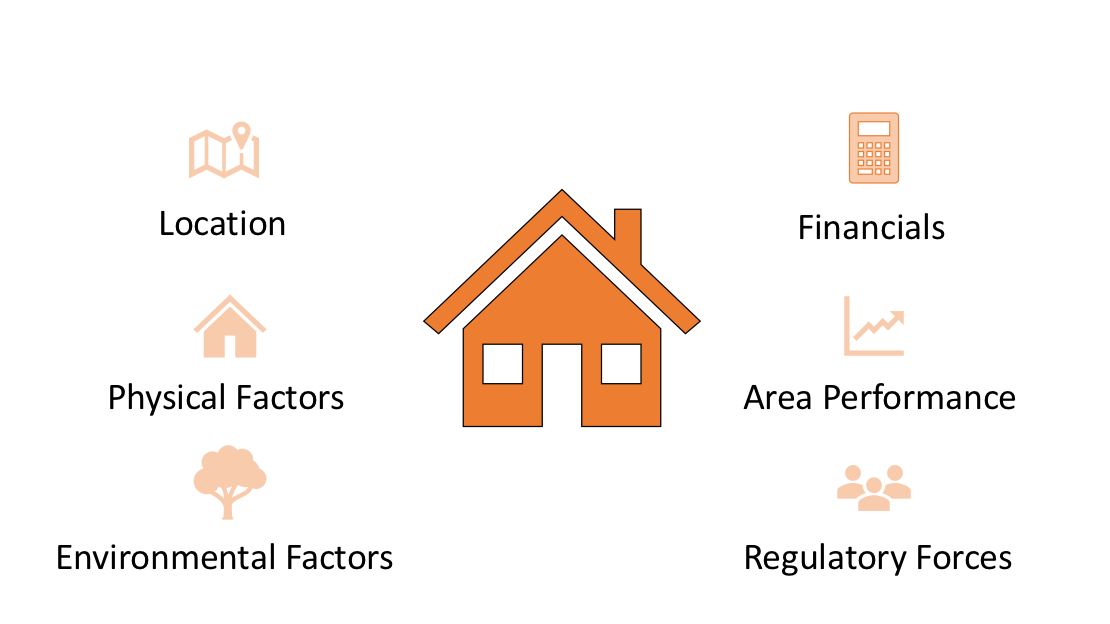

Proximity to features, green room, beautiful sights, and the community's status aspect article source prominently right into household property valuations. Distance to markets, stockrooms, transportation hubs, highways, and tax-exempt areas play an essential duty in commercial residential or commercial property assessments. A key when taking into consideration home location is the mid-to-long-term view regarding exactly how the area is expected to evolve over the financial investment duration.

The Ultimate Guide To Amur Capital Management Corporation

Extensively evaluate the ownership and intended usage of the instant locations where you prepare to spend. One means to collect information concerning the leads of the location of the property you are considering is to call the city center or various other public agencies accountable of zoning and urban planning.

Residential property assessment is very important for funding throughout the purchase, providing cost, financial investment evaluation, insurance coverage, and taxationthey all depend upon realty evaluation. Frequently used realty appraisal approaches consist of: Sales comparison approach: recent similar sales of buildings with similar characteristicsmost typical and appropriate for both new and old residential or commercial properties Expense strategy: the price of the land and building, minus devaluation ideal for new building Income method: based on expected cash money inflowssuitable for rentals Given the low liquidity and high-value financial investment in property, an absence of quality on objective might result in unanticipated outcomes, consisting of monetary distressspecifically if the financial investment is mortgaged. This supplies routine revenue and long-lasting value admiration. However, the character to be a property owner is required to handle possible disputes and lawful problems, handle lessees, repair service job, and so on. This is normally for fast, tiny to medium profitthe common property is unfinished and cost an earnings on completion.

Report this page